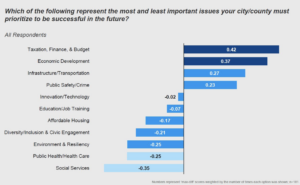

A recent commissioned survey* reported that local public entities view taxation, finance, and budgets as their most important and pressing priorities. In simple terms, it all comes down to MONEY. The need to have enough money to meet public services, programs, and infrastructure needs requires levying taxes, managing budgets, and balancing finances.

Whatever the case may be, the need to produce and manage cash is a critical function for operating, non-operating, and capital planning.

As I have mentioned in previous blogs, one opportunity available to an entity’s finance department to produce a new source of income is through the proper management of its cash.

With finance as a top priority, the need to maximize the value of all cash should be front and center. Just imagine the dramatic effect a five-, six-, or even seven-figure increase in interest income would have in managing your taxes, finances, and future budgeting.

Let me be direct: threeplusone can help your entity proactively manage your liquidity, leading to tens, hundreds, and even millions of dollars in new interest income. And leading to lower taxes, stronger finances, and a simpler budgeting process.

If taxation, finance, and budgeting are top priorities for you, now is the time to proactively manage all your cash—with threeplusone helping ensure your success.