Case Studies

Data tells a story. Let real results from your colleagues show the benefits and liquidity analysis power of cashVest® by three+one®.

We talked to the most skeptical counties. When they bought in, and realized the power of the solution, that’s when we realized, ‘let’s take this national.’

NACo EDGE Executive Chairman | Bill Jasien

Case Study 1

- Suffolk County, NY

Suffolk County, one of the largest counties in the country, began using cashVest® by the three+one® to complement the work being done by their cash-management, finance, and audit departments.

Annual budget across departments

Benefit year to date (2023)

Suffolk County, NY

Streamlining Service Arrangements

With a $3.2B annual budget across multiple departments, the County’s leaders were optimistic that leveraging the massive amount of financial data generated by their operations could lead to new and significant benefits for the taxpayers.

Since bringing the cashVest® program onboard, the County has realized seven-figure increases in the value they’ve received on deposits. The Covid-19 pandemic and CARES Act brought new challenges that the County was able to more easily navigate because of their confidence in the liquidity patterns and value on cash using marketplace benchmarks.

A comprehensive treasury services review allowed the County to evaluate their banks on an “apples-to-apples” basis and streamline service arrangements which led to $299,000 in fee savings.

A unique program that no other company or service can provide.

NY Association of Counties Executive Director | Steve Aquario

Case Study 2

- Orange County, NY (increased its cashVest® score from 63 to 96)

When the Finance Commissioner of Orange County, NY, began working with three+one®’s cashVest® program, he was admittedly skeptical about the benefits that a third-party data company could provide to their office.

New Opportunities

As an $814MM+ annual budget county just outside of New York City, they did not feel their options in the banking and investment marketplace were limited in any way. The cashVest® program quickly uncovered new opportunities for their office to generate over $11M in additional revenue for the taxpayers.

They are now outperforming benchmarks by 5x in Quarter 1 of 2021. The County used time-horizon data to guarantee value on funds for longer durations than ever before, and they are still realizing much of these benefits today. When extreme uncertainty hit in early 2020, the County’s finance office relied on cashVest’s liquidity forecast model to project what resources were going to be available in the event of significant revenue shortfalls.

three+one® also helped to enhance the County’s IPS to coincide with NYS investment guidelines and the Commissioners’ liquidity-management practices.

Total annual budget

In additional revenue for taxpayers

Orange County, NY

Outperforming benchmarks in Quarter 1 of 2021 by

Case Study 3

- Westmoreland County, PA (increased its cashVest® score from 60 to 90)

Westmoreland County, PA, partnered with three+one ® in 2017 to ensure their taxpayers’ dollars were being maximized.

Total county budget

In additional value in 12 months

Suffolk County, NY

Currently exceeding benchmarks by approximately

Adding Additional Value

With a $339MM budget, cashVest® supercharged the County’s ability to bring additional value to their taxpayers. Through continual stress testing and peer benchmarking of the County’s cash, cashVest® provided data resources that let them know where and how long to place its short- and long-term operating funds; that led to over more than $486,000 in additional value over just the last 12 months!

These are benefits that the County Commissioners are very proud of. By using the rfpPrep® digital portal to issue an investment services RFP, the County had an apples-to-apples comparison of each proposer, and eliminated significant time spent evaluating responses. That led to $155,000+ in additional revenue over the last 12 months, on top of the finance team’s time savings of over 50%.

Additionally, as an independent third party, three+one®’s rfpPrep® platform provided an objective scoring breakdown to show taxpayers how the County arrived at its final decision. Because the County followed the data, and shared it with its investment partners, the finance staff was able to mitigate the marketplace shifts that transpired in 2020. As a result, all of the County’s operating cash is currently exceeding its benchmarks by approximately 400%.

Case Study 4

- City of Columbia, SC

Uses cashVest to execute borrowing, investing, and cash-management decisions with more confidence and greater ease.

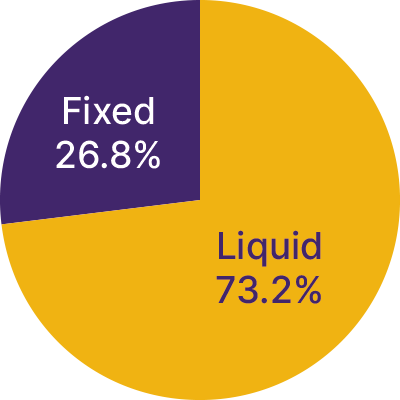

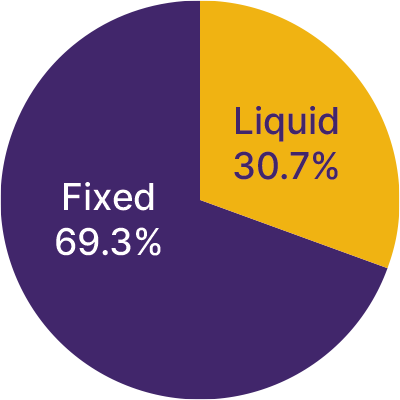

Utilizing cashVest's liquidity data

cashVest's Results

Annual budget across departments

Identified in strategic liquidity

Through continual stress testing and peer benchmarking of the City’s cash, cashVest provided data resources allowing them to know where and how long to place its short- and long-term operating funds, leading to over $16.35 million in additional value since the engagement began five years ago—averaging $3.27 million annually—used to bolster services and programs for its residents.

This equates to 8.93% of the City’s annual property taxes—money that did not have to be raised by increasing property-tax revenues.

Initial Report

cashVest Recommendation

Public Sector & Education Case Studies

Interested in seeing more Case Studies? Enter your email to access the PDF below.

"*" indicates required fields