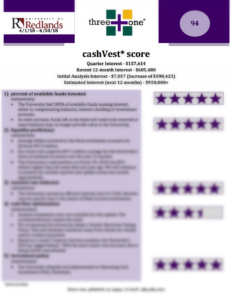

These numbers are real: from $20,000 to $418,000 in FY 2017 (June 2016-June 2017) to $605,000 in FY 2018 (June 2017-June 2018)—and now to a projected $950,000+ for FY 2019. These are the consistent numbers for the University of Redlands (Redlands, CA) on the interest earned on all their cash.

The numbers really add up and they’re meaningful. This is not an aberration, but rather the result of a proactive approach in managing cash as an asset. It has led to a continual flow of income for the university year over year. In fact, over a period of five years, the level of new income generated by this initiative will top $5 million.

Each of the clients threeplusone serves is seeing real numbers like these on a similar scale. While the nation’s strong economic climate, coupled with higher short-term interest rates are helpful components to higher interest earnings, the common dominator to higher yield is the underlying liquidity data used to unmask all levels of cash for investment.

So what does one do to get started? The simplest step would be to contact threeplusone. Our first step would be a comprehensive liquidity analysis on the entity’s total cash position, determining the time value of all its cash, and identifying its value in the marketplace. Our pure and independent data enables a proactive approach that can be used with your financial institutions to capture the highest level of interest earnings on all cash—without jeopardizing any necessary legal, safety, or liquidity requirement.

Impressed with University of Redlands’ numbers? With our help, they could be yours—and used to benefit those you serve.

For more about how the University of Redlands’ is leading the way please read our October 2017 Blog