It does not take a crystal ball to see that uncertainty in our world is at an all-time high. Whether you’re discussing the global economy, local governments, or even our day-to-day lives as citizens, we have very few definitive answers about the future. If you talk to a public finance official, though, you may realize that this is just a more severe version of situations they must consider regularly.

Elected officials and budget officers are continually asked to complete the impossible task of predicting the future. This year will certainly bring new challenges and learning lessons for everyone. It will also expose the strengths of the savviest cash managers—and their budget officers will be thanking them. These finance officials did not leave the value of their taxpayers’ dollars to chance. They used data to confidently lock in interest rates on dollars that weren’t needed for immediate use.

Elected officials and budget officers are continually asked to complete the impossible task of predicting the future. This year will certainly bring new challenges and learning lessons for everyone. It will also expose the strengths of the savviest cash managers—and their budget officers will be thanking them. These finance officials did not leave the value of their taxpayers’ dollars to chance. They used data to confidently lock in interest rates on dollars that weren’t needed for immediate use.

Wayne County, NY and its Treasurer, Patrick Schmitt, are shining examples of this practice into action.

When COVID-19 was spreading across the United States and the Federal Reserve responded by cutting rates from 1.25% to near 0%, Wayne County was able to earn an effective rate over 1.30% across all taxpayer dollars it held—not just those that were invested. With the power of cashvest® by three+one® supporting the County since 2015, its finance policy has been focused on maximizing opportunities available and guaranteeing future revenues.

Today, with the help of three+one®’s MC Short-Term Forecast®, Wayne County is able to monitor and project its liquidity position into the future so that finance officials can plan for any necessary withdrawals from or potential contributions to the County’s fixed-income portfolio.

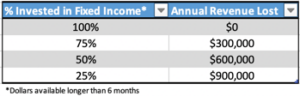

For the past three years, Wayne County has managed to keep nearly 100% of its funds identified as being available longer than six months invested in fixed income. This amounts to 80% of its total liquidity position producing interest earnings that can be calculated and budgeted because of their fixed interest rates. Had the County only been using a liquid investment pool to manage these dollars, it would have seen the annual value on its funds drop by 75% or more in just a matter of weeks.

For the past three years, Wayne County has managed to keep nearly 100% of its funds identified as being available longer than six months invested in fixed income. This amounts to 80% of its total liquidity position producing interest earnings that can be calculated and budgeted because of their fixed interest rates. Had the County only been using a liquid investment pool to manage these dollars, it would have seen the annual value on its funds drop by 75% or more in just a matter of weeks.

The year 2020 has been unlike any other. But, if there is one thing that we can all take from the past six months, it’s that changes are going to continue to happen more quickly and more frequently going forward. Because uncertainty will always be with us, it is essential that public finance officials count on what can be counted—and lock in the value they receive on every taxpayer dollar.