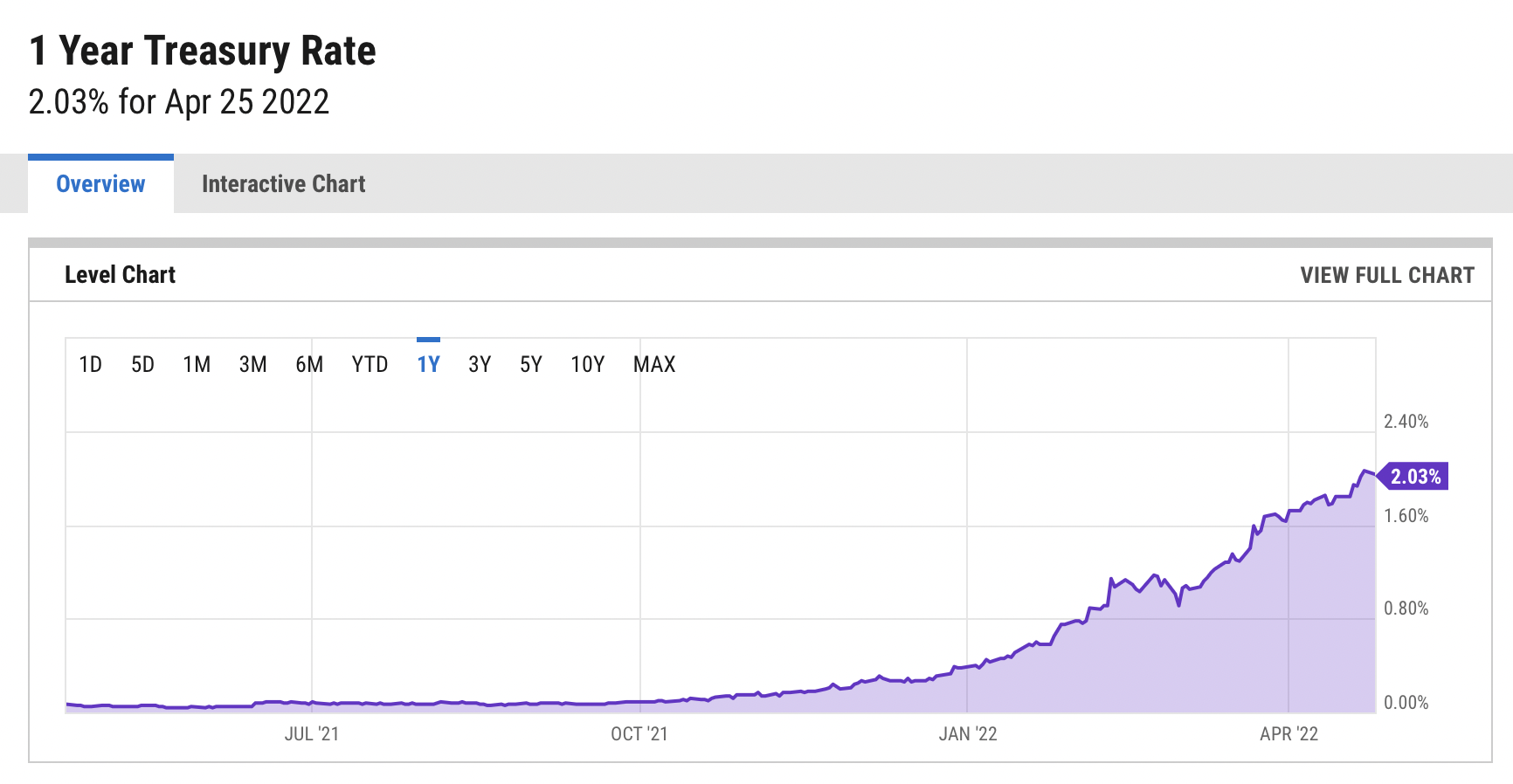

Short-term interest rates are rising and so is the value of all cash that you have on hand. This time last year the average yield on cash was only .05%. That rate is now above .30% and will likely be well over 1.0% in July, with the one-year Treasury rate topping 2.50%.

If your deposit and/or investment rate isn’t rising at the same pace as the U. S. Treasury rate is, then you’re not in the running—you’re not keeping pace with the value your cash has in the marketplace.

If your deposit and/or investment rate isn’t rising at the same pace as the U. S. Treasury rate is, then you’re not in the running—you’re not keeping pace with the value your cash has in the marketplace.

In a rising-rate environment, all cash—whether it’s from tax or tuition dollars—are seen as valuable assets in the marketplace. Now is the time to use accurate and updated liquidity data to analyze and assess the level of cash you have for investment. And put that cash effectively to work through your financial institutions.

Remember, liquidity data + higher interest rates = more revenue for your budget.

Remember, liquidity data + higher interest rates = more revenue for your budget.

We developed cashVest®, our innovative liquidity data and cash-management solution, to help public entities and higher Ed institutions like yours maximum the value of all cash. Contact us to learn why NACo views cashVest as a best-management financial tool, especially in a rising-rate environment.