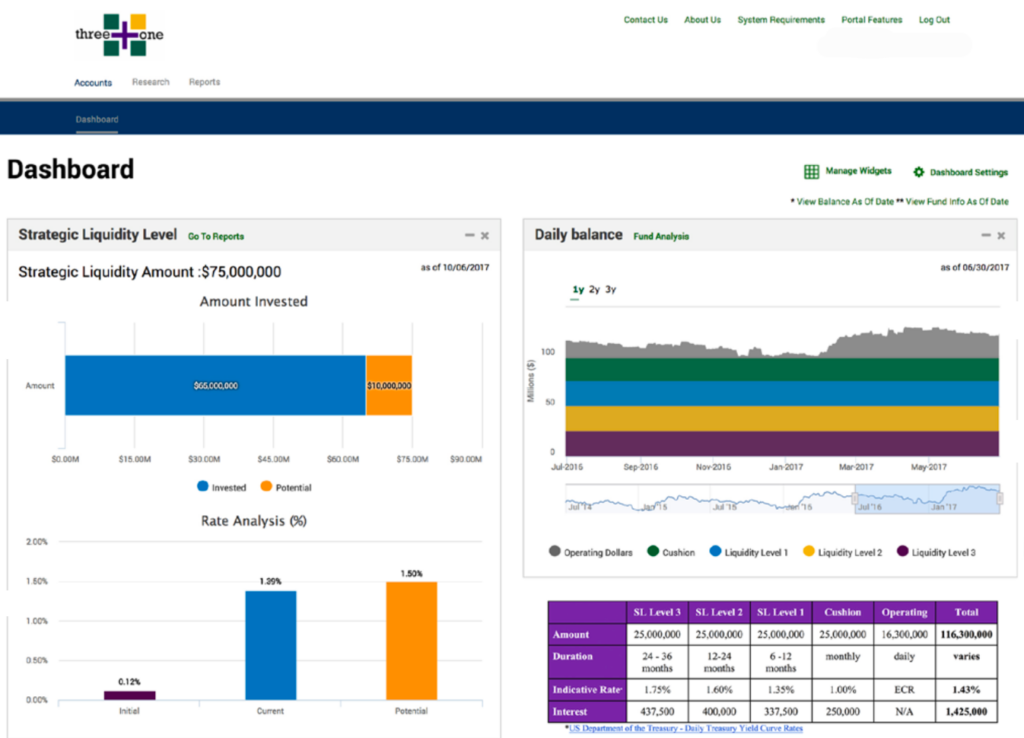

Over the last four years, we at threeplusone have focused much of our attention on encouraging public and higher Ed entities to perform liquidity projections on all their cash. This is both to meet expenses as well as to be proactive in managing excess cash as a revenue-generating asset.

The basis of putting cash to work is through liquidity analysis.

In the coming year, liquidity analysis will be taken to a whole new level for all non-profit organizations. Starting in January, the Financial Accounting Standards Board (FASB) will require all non-profit organizations to disclose liquidity levels to cover expenditures on an annual basis and for future years. The ability to pay one’s bills and the source of such monies will need to be both explained and charted, with appropriate supporting data to follow.

As I have mentioned in the past, liquidity analysis is far different than the ebbs and flows of cashflow forecasting; it requires a specific niche of expertise.

This should not be a worry to those who take advantage of threeplusone’s cashVest® report. This proprietay report provides an extensive liquidity analysis with a modeling of algorithm factors in the stress level of both a public entity’s or higher Ed institution’s current cash obligations and future commitments. Our systems foresee unexpected cash needs and strains and can prepare entities to handle them well in advance. What’s more, you can be confident that our cashVest reports will be fully FASB compliant.

The ability to meet FASB Liquidity Analysis standards does not have to be a arduous process. Rather, think of it as a proactive approach to viewing all levels of cash and your ability to meet day-to-day expenditures. As we have been advocating for four years, this process will identify all cash and its ability to be a revenue-generating asset.

We fully expect the Governmental Accounting Standards Board, (GASB), will adopt this same standard in the coming years.