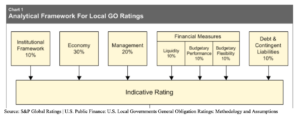

Liquidity data has, again, come into focus as S&P Global Ratings has reassessed its local government ratings measures to include seven new criteria of which one is “liquidity.” The new “Liquidity Score” actually measures the availability of cash (and cash equivalents) in the short, medium, and long term. Liquidity now makes up 10% of the framework for local GO ratings at S&P.

According to S&P, the chart below outlines a summary of the basis for providing a local government’s GO rating.

Among the other qualitative factors that positively affect this Liquidity Score, two of the most often highlighted are: (1) Liquidity projections for the current year and the following year, and (2) “Robust and stable” cash-flow capacity compared with peers.

Among the other qualitative factors that positively affect this Liquidity Score, two of the most often highlighted are: (1) Liquidity projections for the current year and the following year, and (2) “Robust and stable” cash-flow capacity compared with peers.

We all know governments carry cash on the balance sheet for liquidity needs, reserves, etc., but do you have a forward-looking analysis evaluating cash and how it can be used to provide stability and generation of value to your taxpayers? According to S&P, this can increase your Liquidity Score and potentially have a positive impact on your entity’s credit rating.

In assessing your entity’s readiness to prepare for more attention and scrutiny regarding liquidity, here are four questions you should consider:

(1) What ongoing mechanisms are in place to help your liquidity management?

(2) Does your entity have control and oversight of liquidity data?

(3) How does your entity qualitatively and quantitatively provide liquidity data to help maximize the value brought to the taxpayers on cash?

(4) What is your entity’s cash-flow capacity compared with peers?

Aside from credit rating agencies placing an emphasis on liquidity, liquidity data have also come into focus as FASB issued an Accounting Standards Update (ASU) requiring not-for-profit entities to disclose in the notes to their financial statements relevant information about their liquidity position. These liquidity disclosures require numerical details about the actual liquidity position of a not-for-profit.

Aside from credit rating agencies placing an emphasis on liquidity, liquidity data have also come into focus as FASB issued an Accounting Standards Update (ASU) requiring not-for-profit entities to disclose in the notes to their financial statements relevant information about their liquidity position. These liquidity disclosures require numerical details about the actual liquidity position of a not-for-profit.

Your entity may have controls, internal experts, and time to provide and perform these types of analyses on a regular basis, and if not, three+one® can provide you with the tools, data, and peer comparisons to ensure you’re always prepared to have a credit rating that looks its best.

Sources:

https://www.standardandpoors.com/en_US/web/guest/article/-/view/type/HTML/id/2313704

https://www.governing.com/topics/finance/gov-credit-ratings-still-matter.html

http://www.msrb.org/~/media/Files/Education/Credit-Rating-Basics-for-Municipal-Bond-Investors.ashx??