ENHANCE YOUR COUNTY’S CASH PRACTICES

Start a conversation:

Find us:

We're social:

THINK USING YOUR COUNTY’S LIQUIDITY AS A REVENUE GENERATOR IS NOT WORTH THE TIME AND EFFORT? THINK AGAIN.

By William Cherry, Director of Public Partnerships

I am always surprised when I meet a county finance official who doesn’t practice advanced liquidity management techniques because they think the financial results will not be worth their time and effort. Nothing could be further from the truth. Even in a low-interest-rate environment, employing effective cash management practices can mean millions of dollars in additional revenues to small and mid-size counties, and tens of millions to larger counties. But before I prove that to you, let me first describe what effective liquidity management means.

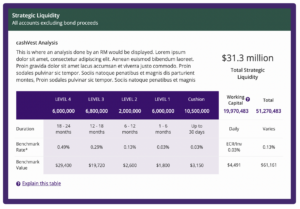

Quite simply, it means managing the public funds that are on deposit in your municipal bank accounts in the most effective ways possible in order to maximize interest income and to bolster non-tax revenues. It means regularly determining how much liquidity you have available to invest using a combination of certificates of deposit, U.S. Treasury bills, municipal bonds, or other fixed-time deposit investments as permitted under your county’s adopted Investment Policy. Then, by using future cash forecasting, you need to determine how long some of those funds will remain on deposit before they will be needed for operating expenses. And once you know how much cash you have available and how long some of those pockets of liquidity will remain on deposit, you can then determine which investment, for which timeline, and at which bank, will pay your county the highest rate of return on those dollars. Most county finance officials try to practice this kind of cash management at least to some extent, but given limited staff and only so many hours in the day, it’s sometimes very low on the priority list.

So – is advanced liquidity management worth the effort? You bet it is. In order to substantiate that claim, I am going to highlight three different counties from across the U.S. who have drastically improved their earnings by using the latest in liquidity analysis tools. In order to measure the true impact of effective liquidity management, I first calculated how much each of these counties would have earned over the past 12 months had their funds remained on deposit in daily money market accounts or general deposit accounts. Those are reliable options for SOME of your day-to-day operating funds – but they are not good options for ALL of your funds – especially when those funds could remain on deposit for many months. Here are some examples of what effective liquidity management can do for a county:

Wayne County, NY (90,000 residents) is an example of excellent liquidity management practices. They earned a total of $828,000 in interest last year versus the $60,000 they would have earned had their deposits been earning at the 2021 average daily U.S. Treasury rate of 5 basis points. Over the past six years, Wayne County has earned more than $7 million in interest income!

Beaufort County, SC (population: 192,000) is another great success story. They earned interest totalling $1,317,000 in 2021, and they would have only earned $88,000 at U.S. Treasury daily rates. Beaufort County has earned an incredible $15.5 million in interest income during the four-year period of 2018 through 2021 by employing liquidity management techniques.

Chautauqua County, NY (pop: 127,000) pocketed $806,000 in interest in 2021 whereas they would have earned just $20,000 at daily rates. Total interest earned 2019-2021 comes to more than $4.0 million dollars.

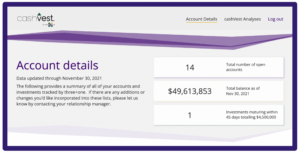

One thing all of these counties have in common is their partnership with three+one®. NACo understands that reliable liquidity analysis helps counties more effectively manage their cash, resulting in dramatically higher interest earnings, lower debt service costs, as well as stronger credit ratings. three+one® is very proud to be endorsed by NACo. We employ the latest financial technology to help finance officials determine precisely how much liquidity they have available and we provide accurate future forecasts of how long those funds will remain on deposit. We also provide market comparison benchmarks and a listing of the best available interest rates in your area. Our advanced online liquidity tools and regular summary reports save time, make a CFO’s life easier, and help them maximize their interest earnings. And I can promise you this… the results are well worth the effort.

William Cherry can be reached by phone at 585-484-0311, ext. 709 or by email at wec@threeplusone.us