Blog

The latest news in the world of cashVest®.

- All

- Banking Relationship

- Banking Trends

- Budgets

- Cash Management Practices

- Data & Technology

- Fintech

- Higher Ed

- Liquidity Analysis

- News

- Pathway to Recovery

- Predictions

- RFP

- Safety vs. Complacency

- Summer Blog Series

- Time Horizon

- Uncategorized

- vlog

- Winter Blog Series

Top 10 Predictions For 2019

Over the last several years, three+one has blogged frequently about the changing landscape of banking and the value of cash as an asset. Last year ...

Read More

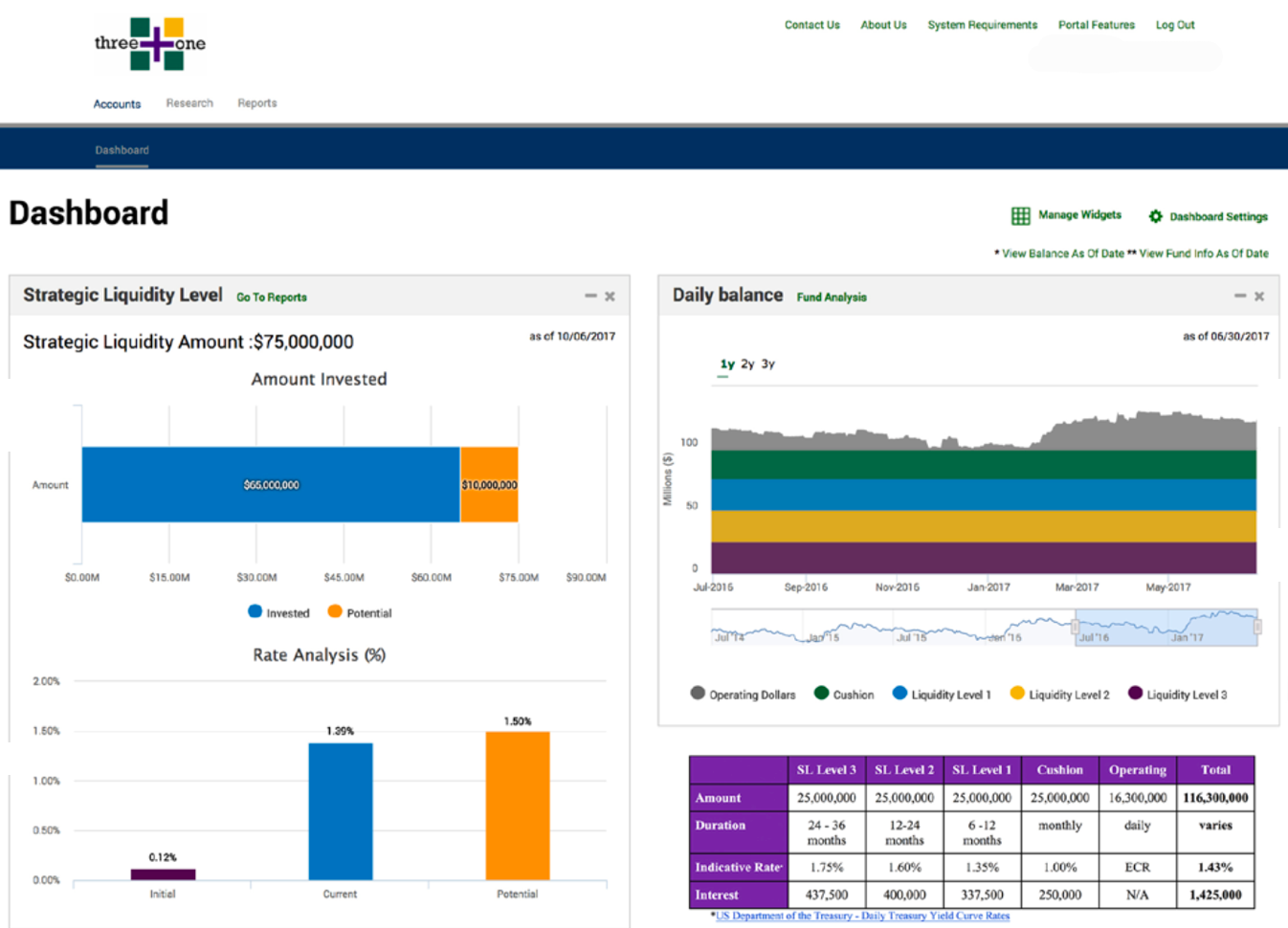

Got Liquidity Analysis?

Over the last four years, we at threeplusone have focused much of our attention on encouraging public and higher Ed entities to perform liquidity projections ...

Read More

The Analytics Revolution

The Information Age and resulting new technologies have led to a a paradigm shift in the way the world makes decisions. Look no further than ...

Read More

Happy Thanksgiving!

Thanksgiving wishes from across the miles from our office to yours. May you have a blessed & bountiful Thanksgiving with friends and family! -Joe, Peter, ...

Read More

The Real Cost

When it comes to comparing the cost of banking services, the need to dig below the surface is necessary. Most public entities will conduct banking ...

Read More

Every Quarter Matters

Each time the Federal Reserve raises interest rates by a quarter of a percent, the higher the value of your cash. Earlier in the year, ...

Read More

Either Way

Recently the Federal Reserve has come under increased pressure to pull back on its rising-rate strategy, which started at the end of 2017. Over the ...

Read More

By A Simple Vote

It’s a real pleasure for us to celebrate the work of others in our community—especially when the impact of that work is felt around the ...

Read More

Good News For You & The Banks

The trends continue: short-term interest rates are still on the rise, the economy is growing, technology is advancing, and banks want your business. That is ...

Read More

Differences Can Come Together

In a politically charged environment that has polarized our differences, there is still a world in which differences can come together. That world is cash! ...

Read More