Blog

The latest news in the world of cashVest®.

- All

- Banking Relationship

- Banking Trends

- Budgets

- Cash Management Practices

- Data & Technology

- Fintech

- Higher Ed

- Liquidity Analysis

- News

- Pathway to Recovery

- Predictions

- RFP

- Safety vs. Complacency

- Summer Blog Series

- Time Horizon

- Uncategorized

- vlog

- Winter Blog Series

Smart Tech Means Smart Finance

AI and chatGPT may be dominating the news, but cashVest is the smart FinTech tool your public entity really needs right now.

Read More

Don’t Leave Money On the Table

Alfred University President Mark Zupan shares the positive results his institution realized with cashVest by three+one.

Read More

The Speed of Money: Understanding the SVB Collapse

The speed of financial transactions has increased significantly in recent years, thanks to advances in technology and the growth of the global economy.

Read More

Safety. Diversity. Confidence.

When all the facts and financial data are right at your fingertips, it’s a lot easier to get a good night’s sleep.

Read More

Your Colleagues Are Talking About cashVest

Listen to what your colleagues like Treasurer Sanford have to say about the financial benefits realized through our cashVest liquidity management and data solutions.

Read More

Protect Your Revenue With Liquidity Data

With cashVest's liquidity data, your entity can make decisions that protect and preserve interest income and budget lines.

Read More

$1B and Counting

1 Billion. That is how much cashvest and our liquidity management tools have earned or saved public entities of every size and budget.

Read More

Timing Isn’t Everything

When it comes to improving public-sector finances, a better motto might be “There’s no time like the present.”

Read More

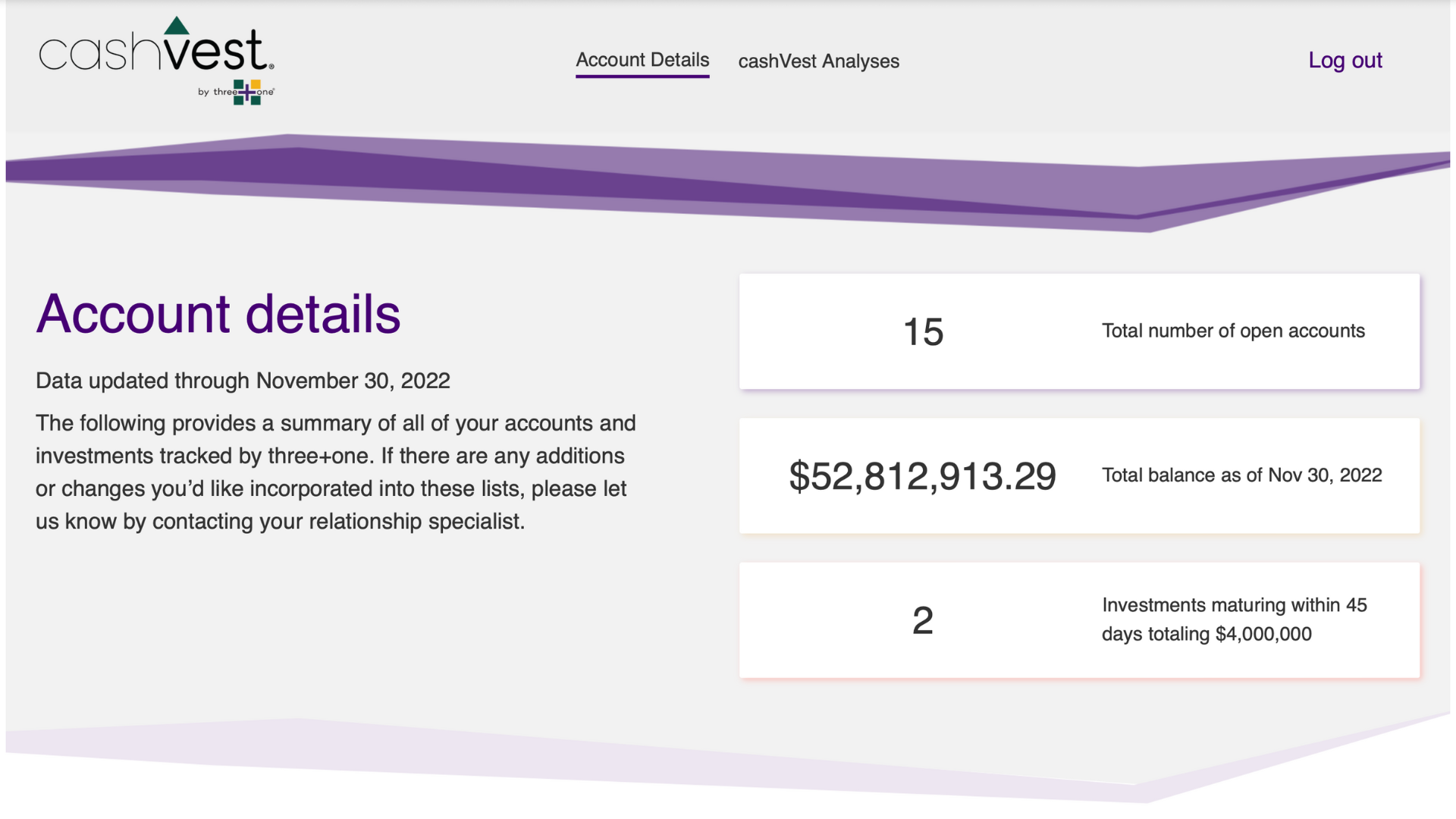

New Year. New Features.

The cashVest portal has improved tools & insights. You spoke. We listened.

Read More

Missing Out On $1,200 Or More Per Day

For all public entities, 2023 should be the year to reconsider what a powerful asset cash can be. It’s no longer a luxury to invest ...

Read More

Working To Better Communities — Including Our Own

Bettering every community we touch with our innovative financial technology is in our firm’s DNA.

Read More

Our Commitment to DEI

At three+one, we know that equitable employers outpace industry benchmarks by respecting the unique needs, perspectives, and potential of all their team members.

Read More