Blog

The latest news in the world of cashVest®.

- All

- Banking Relationship

- Banking Trends

- Budgets

- Cash Management Practices

- Data & Technology

- Fintech

- Higher Ed

- Liquidity Analysis

- News

- Pathway to Recovery

- Predictions

- RFP

- Safety vs. Complacency

- Summer Blog Series

- Time Horizon

- Uncategorized

- vlog

- Winter Blog Series

Your Colleagues Are Talking About cashVest

Listen to what your colleagues like Treasurer Sanford have to say about the financial benefits realized through our cashVest liquidity management and data solutions.

Read More

Protect Your Revenue With Liquidity Data

With cashVest's liquidity data, your entity can make decisions that protect and preserve interest income and budget lines.

Read More

$1B and Counting

1 Billion. That is how much cashvest and our liquidity management tools have earned or saved public entities of every size and budget.

Read More

Timing Isn’t Everything

When it comes to improving public-sector finances, a better motto might be “There’s no time like the present.”

Read More

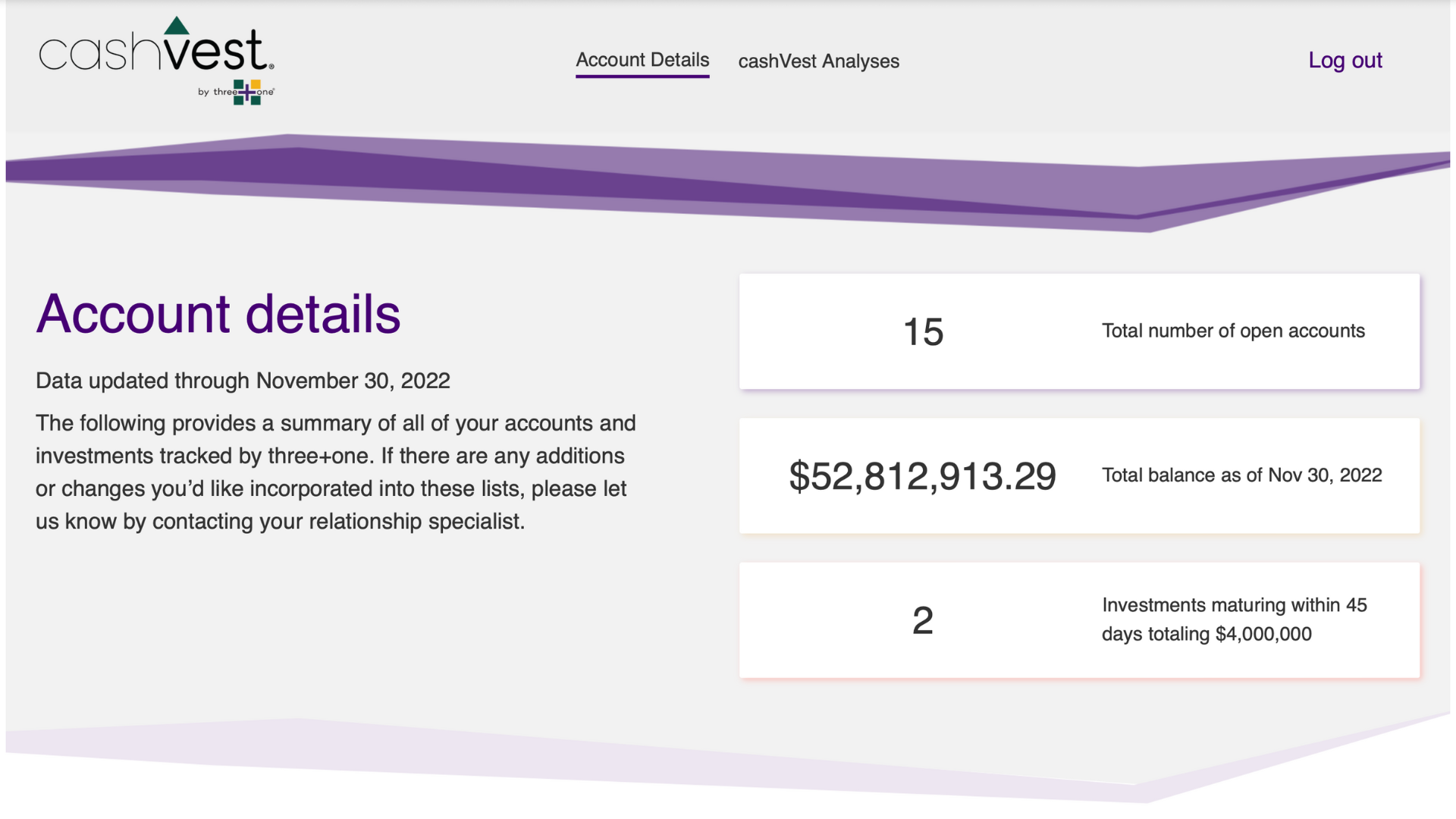

New Year. New Features.

The cashVest portal has improved tools & insights. You spoke. We listened.

Read More

Missing Out On $1,200 Or More Per Day

For all public entities, 2023 should be the year to reconsider what a powerful asset cash can be. It’s no longer a luxury to invest ...

Read More

Working To Better Communities — Including Our Own

Bettering every community we touch with our innovative financial technology is in our firm’s DNA.

Read More

Our Commitment to DEI

At three+one, we know that equitable employers outpace industry benchmarks by respecting the unique needs, perspectives, and potential of all their team members.

Read More

The Delta Factor

The gap, or “delta,” between passively managing those funds vs. using active liquidity management often averages 1.5% to 2.0%.

Read More

NYSAC Podcast: 2023 Economic Forecast

On this week's episode of NYSAC's County Conversations podcast, CEO Joe Rulison provides a financial outlook and predictions for county leaders in 2023.

Read More

What We Are Not

Our data analysis allows public finance officials to have confidence that every tax dollar that is available for investment is put to use.

Read More